New Delhi [India], September 12 (ANI): Indian REITs ship about 6-7 per cent yields, surpassing world benchmarks, in line with a joint report by ANAROCK-CREDAI. Since the first REIT itemizing in 2019, the sector has reached a market capitalisation of roughly USD 18 billion as of August 2025.

With three extra REITs anticipated over the subsequent 4 years, India is projected to cross USD 25 billion in market capitalisation, the joint report has asserted.

The report ‘Indian REITS: A Gateway to Institutional Real Estate’ by oUicial information accomplice ANAROCK Capital and CREDAI, unveiled right now on the CREDAI NATCON in Singapore, examines the Indian REIT panorama in wonderful element.

As per the definition, REITs, or actual property funding trusts, could be described as an organization that owns and operates actual property to generate earnings.

Shobhit Agarwal, CEO – ANAROCK Capital, stated, ‘Indian REITs are late to the celebration, however now lead the dance. Despite its late entry in comparison with world friends, India has sturdy fundamentals. The distribution yields, at the moment averaging at 6-7%, are properly above many mature markets such because the US and Singapore, amongst others.’

Shekhar Patel, President, CREDAI, famous that over 60% of India’s REIT market worth right now rests with very small set of gamers, with a robust base in Grade A workplaces linked to IT and BFSI.

‘The future, nonetheless, holds far wider promise. As India’s cities develop, infrastructure strengthens, and the economic system diversifies, REITs will increase into retail, logistics, housing, and new-age belongings. This transformation will unlock unprecedented alternatives for buyers and firmly place India among the many most dynamic REIT markets on the planet,’ Patel added.

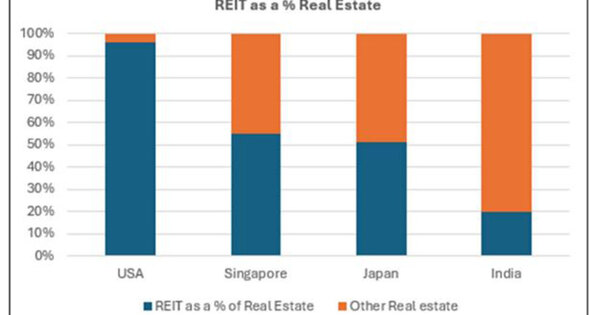

Despite REIT tips being launched in 2014 and the primary itemizing solely in 2019, Indian REIT market accounts for simply 20% of institutional actual property, far under the USA (96%) and even Asian friends like Singapore (55%) and Japan (51%). In developed markets just like the USA and Singapore, dividends from REITs are typically taxed at decrease charges, making them extra engaging for retail buyers in comparison with India, it opined.

This restricted penetration is essentially as a result of Indian REITs are thus far concentrated in Grade A business workplace belongings, which supply scale, transparency, and steady money flows.

As the market matures, diversification is anticipated by way of information centres and logistics REITs, supported by rising digital demand and e-commerce development, whereas retail mall REITs could comply with with ongoing consolidation, the report famous.

With extra asset courses turning into REITable, India’s penetration might probably rise to 25-30% of institutional actual property by 2030, positioning it as one of many fastest-growing REIT markets globally, it added. (ANI)