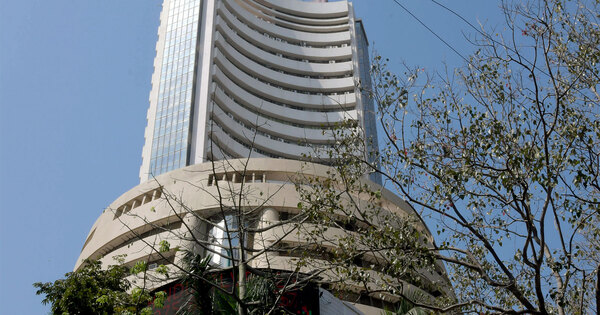

New Delhi [India], October 7 (ANI): Indian fairness markets began Tuesday on a gradual word, with each benchmark indices exhibiting marginal good points. The Sensex opened up 147.29 factors to 81,937.41 at 9.38 am. The Nifty 50 inched up by 41.70 factors to 25,119.35, reclaiming the 25,000 mark.

According to market information, the early uptick got here as banking and steel shares led good points, supported by optimistic cues from abroad markets, regardless of persisting geopolitical and financial uncertainties.

Banking and market skilled Ajay Bagga stated that Indian markets have been shifting in tandem with international tendencies, with PSU financial institution indices touching report ranges.

‘Earnings which begin from October 9 will set the tone for the markets. Indian markets have underperformed the MSCI Emerging Markets index considerably. A catch-up will come finally, however for now, international portfolio buyers stay bearish and the surge in major market issuances creates a liquidity drag for secondary markets,’ he stated.

Bagga additional defined, ‘Markets abhor uncertainty, however they’ve mastered Washington theatre.’ He added that whereas the U.S. authorities shutdown entered its sixth day, American stock markets continued to hit lifetime highs.

Banking and IT sectors present early power in opening. Pharma and steel shares are cautious amid international cues, whereas realty and client discretionary shares are beneath some stress.

Among preliminary public gives (IPOs), the Tata Capital IPO is open for the second day, and the LG Electronics IPO opens for subscription right now. Tata Capital was subscribed about 40 per cent on day one, Monday.

‘Gold and silver proceed their surge, with gold crossing USD 4,000 and silver at USD 48 ranges. Cryptocurrencies are rising as nicely, with Bitcoin doubling within the final yr to USD 125,000,’ he famous.

Gold costs continued their upward trajectory, reaching recent highs amid political and financial unease. Manav Modi, Analyst – Precious Metals Research at Motilal Oswal Financial Services Ltd, stated, ‘Gold costs rose to an all-time excessive, extending good points to a 3rd session on U.S. financial and political uncertainties and expectations of additional rate of interest cuts by the Federal Reserve.’

Global developments additionally performed a job in shaping investor sentiment. Manav stated that the White House eased off earlier claims about authorities layoffs because of the shutdown, however warned that extended gridlock might result in job losses. In foreign money markets, the Japanese yen tumbled sharply in opposition to the U.S. dollar after fiscal dove Sanae Takaichi was elected to guide the ruling get together, signaling coverage continuity.

‘Kansas City Fed Bank President Jeff Schmid signaled he’s disinclined to chop rates of interest additional, arguing that because the Fed navigates between the dual dangers of overly tight and overly straightforward coverage, it ought to keep targeted on the hazard of too-high inflation,’ Manav famous. However, market projections nonetheless value in extra fee cuts in October and December, conserving investor deal with upcoming U.S. Federal Open Market Committee minutes and Federal Reserve Chair’s remarks. (ANI)