TOKYO (TR) – Prosecutors in Tokyo have indicted influencer Reika Miyazaki for concealing practically 500 million yen in revenue by recording fictitious bills.

According to NHK (Dec. 25), the case typifies the struggles tax authorities endure in monitoring the revenue of influencers.

Reika Kuroki, who works beneath the household title Miyazaki, was indicted with out detention. The 37-year-old is the consultant director of the Shibuya Ward-based promoting company Solarie.

According to the Tokyo District Public Prosecutors’ Office Special Investigation Division, Kuroki is accused of violating the Corporation Tax Act and the Consumption Tax Act, amongst different crimes, for concealing roughly 496 million yen in revenue over the three years as much as January of final yr.

Kuroki did this by recording fictitious outsourcing bills, thereby evading roughly 126 million yen in company tax and roughly 31 million yen in consumption tax.

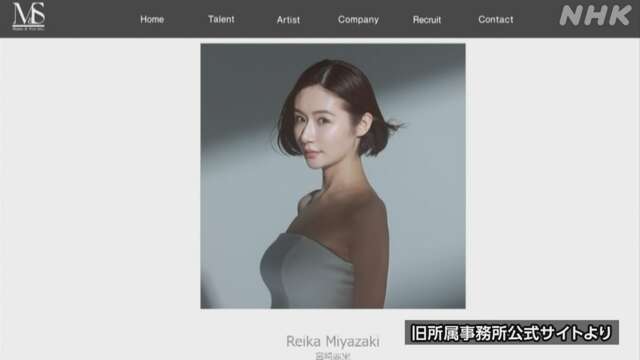

Reika Miyazaki

While working as a trend mannequin and influencer beneath the title Reika Miyazaki, director Kuroki additionally began a variety of companies, together with a cosmetics gross sales firm and the promoting company Solarie.

According to sources, Solarie acquired promoting charges from firms for cosmetics and different merchandise that Kuroki launched on Instagram. She was paid primarily based on the outcomes of the postings. However, the corporate recorded fictitious outsourcing charges to make its revenue seem decrease.

Additionally, Yoshihiko Kitajima, an govt at one other firm run by Kuroki, and Yusuke Aiba, an organization govt, have additionally been criminally charged for aiding within the tax evasion.

The Special Investigation Unit has not revealed whether or not Kuroki and the others have admitted to the fees.

Kuroki issued an announcement saying, “I deeply regret my actions. With the advice of experts, I will promptly make any necessary amended tax returns and file taxes.”

Japan’s No. 1 influencer

On Instagram and Youtube, Kuroki shares her household’s travels to luxurious resorts abroad and her each day parenting routine. In her ebook, she calls herself “Japan’s No. 1 influencer.”

While working as a mannequin, Kuroki began a collection of companies, together with a cosmetics gross sales firm and a consulting agency, and was concerned within the manufacturing of cosmetics and lingerie merchandise.

As an influencer, she amassed over 470,000 followers on Instagram, ceaselessly posting about sporting brand-name merchandise, being invited to luxurious model occasions, and staying at luxurious resorts abroad and in Okinawa.

She seems to have used Instagram to advertise merchandise requested by people and corporations and earned important promoting income by way of affiliate promoting, which pays fee primarily based on outcomes.

Number one influencer

In 2020, she based the promoting company Solarie. According to sources, this company acquired promoting income from cosmetics and different beauty-related firms.

In a ebook revealed two years in the past, she wrote, “I consider myself the number one influencer and marketer in Japan. No one understands digital marketing better than I do.”

In addition to sharing the glitzy, prosperous life-style of an influencer, she additionally ceaselessly shares her on a regular basis life as a mom of 5.

In her ebook, she states, “The era of ‘looking good’ is over. What I value is sharing the real thing. The most popular thing is my family’s daily life. In a world dominated by what looks good, life-sized content is more popular.”

Leveraging Influencers

With the event of social media, firms are more and more promoting on the content material of extremely seen influencers, which has quickly expanded the market.

According to a survey carried out by social media advertising and marketing firm Cyber Buzz and analysis agency Digital Infact, the marketplace for social media advertising and marketing in Japan was estimated at 1.2038 trillion yen final yr, rising by greater than 10 p.c yearly.

Of this, the price range spent by firms on social media advertising and marketing utilizing influencers was estimated to have reached 86 billion yen final yr, a 16 p.c enhance over the earlier yr.

According to Cyber Buzz, the rise in customers watching movies and different content material on social media has led to widespread recognition of influencers, which has resulted in an more and more highly effective affect on folks’s client habits.

National Tax Agency investigating

The National Tax Agency (NTA) is actively conducting tax investigations into new financial transactions akin to internet marketing, contemplating them an necessary difficulty.

According to the company, over the 12 months ending in June of this yr, taxation bureaus throughout the nation carried out 76 tax investigations in opposition to people participating in internet marketing, akin to affiliate promoting, and cited suspicions of malicious fraud.

The NTA has acknowledged that whereas these new financial transactions are producing important earnings, their true nature is obscure. As a outcome, it has been strengthening its data gathering efforts since 2019.