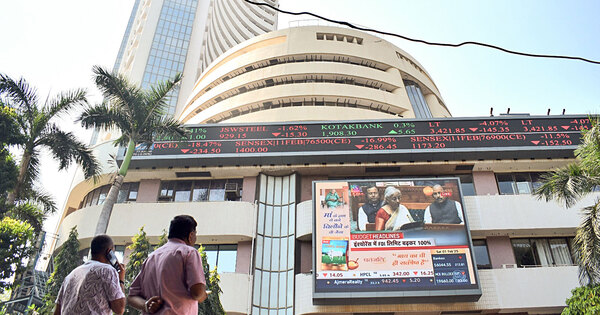

Mumbai (Maharashtra) [India], February 2 (ANI): Domestic stock markets recovered from early losses and moved into constructive territory in early commerce on Monday after opening decrease amid promoting stress triggered by the hike in Securities Transaction Tax (STT) introduced within the Union Budget.

The benchmark Nifty 50 index opened at 24,796.50, down by 28.95 factors or 0.12 per cent, whereas the BSE Sensex opened at 80,555.68, slipping 167.26 factors or 0.21 per cent. However, the indices quickly pared losses, with the Nifty gaining 0.3 per cent within the early buying and selling session, whereas the Sensex jumped 372 factors.

Market members remained cautious following the sharp response seen after the Budget, however selective shopping for helped the benchmarks get better from the opening lows.

Ajay Bagga, Banking and Market Expert, advised ANI on market outlook, ‘We count on some extra promoting and there will probably be promoting at each rise. There is time until April 1st for the upper taxes to come back in. There are many positives within the Budget. That ought to assist Indian markets that are in heavy oversold zone. The Union Budget 2026 displays a strategic shift from short-term stimulus to long-term structural resilience. It balances fiscal self-discipline with a focused push for manufacturing and the providers sector. Positives are fiscal self-discipline, increased tax revenues and sectoral beneficiaries will generate progress’.

Data on fund flows on finances day confirmed continued promoting stress, with international institutional buyers (FIIs) promoting equities price Rs 588.3 crore, whereas home institutional buyers (DIIs) additionally remained internet sellers to the tune of Rs 682.7 crore.

In the broader market, efficiency remained combined. On the NSE, the Nifty 100 rose by 0.13 per cent, whereas the Nifty Midcap 100 slipped 0.21 per cent and the Nifty Smallcap 100 declined 0.49 per cent.

Sectoral indices on the NSE additionally confirmed a combined development. Nifty Auto was down 0.11 per cent, Nifty FMCG fell 0.61 per cent, Nifty IT declined 0.59 per cent, Nifty Media misplaced 0.40 per cent, and Nifty Pharma was down 0.5 per cent. Meanwhile, Nifty Oil & Gas and Nifty Metal opened within the inexperienced, offering some assist to the broader market.

Gold costs continued their downward development on the MCX, buying and selling at Rs 143,321 per 10 grams, down 3 per cent.

Ponmudi R, CEO of Enrich Money, stated, ‘Indian markets might stay underneath stress following the sharp unfavourable response to the Union Budget 2026-27, triggered by a shock hike within the Securities Transaction Tax (STT) on derivatives. Futures STT has been raised to 0.05 per cent from 0.02 per cent, whereas choices STT has been elevated to 0.15 per cent from 0.10 per cent/0.125 per cent, considerably elevating buying and selling prices and weighing on F&O-heavy shares and brokerage counters. While DII shopping for might provide some assist, near-term sentiment stays cautious to mildly bearish’.

In different Asian markets, sentiment remained weak. Japan’s Nikkei 225 index was down 0.81 per cent, Singapore’s Straits Times fell 0.34 per cent, Taiwan’s weighted index declined 2 per cent, and Hong Kong’s Hang Seng index was down 2.4 per cent. (ANI)