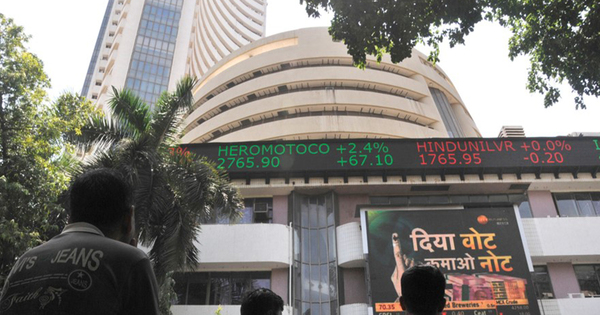

Mumbai (Maharashtra) [India], December 8 (ANI): The flat motion has returned to the Indian stock markets after a optimistic rally witnessed final weekend, with home indices opening barely decrease on Monday.

The traders adopted a cautious method forward of the US Federal Reserve assembly scheduled on December 9-10.

Market members stay watchful over world financial cues, tariff readability, and geopolitical developments that would form investor sentiment within the remaining weeks of the yr.

The NIFTY 50 index opened at 26,159.80, registering a decline of -26.65 factors or (-0.10 per cent), whereas the BSE Sensex started the session at 85,624.84, down by -87.53 factors or -0.10 per cent.

Experts famous that India’s home fundamentals stay sturdy and the current RBI price reduce has additional offered help; nonetheless, traders are awaiting concrete developments on tariff-related points earlier than decisively collaborating in a year-end rally.

Ajay Bagga, Banking and Market Expert, informed ANI, ‘For Indian markets, the RBI delivered a price reduce on Friday, resulting in a lift in rate of interest sensitives apart from actual property gamers. The Fed price reduce might be welcomed as that ought to ultimately result in a weaker US dollar and stronger EM inflows. The US commerce delegation’s go to is elevating hopes for some aid on the tariff entrance. We count on Indian markets to do nicely, and any aid on the US tariffs entrance may lead momentum to a year-end rally.’

Bagga additional added, ‘A hawkish Fed price reduce would be the dominant theme this week in world markets. The Fed is anticipated to chop charges by 25 foundation factors, however a major variety of the 12 voting members of the FOMC are anticipated to dissent, making the reduce a hawkish-toned one.’

In the broader market, the Nifty 100 opened down by 0.2 per cent, and the same development was seen throughout Nifty Midcap and Small Cap indices, which opened in pink, reflecting stress on non-index heavyweights.

Across sectoral indices on the NSE, the efficiency remained blended throughout the opening session. Nifty IT, Media, and Metal sectors began in optimistic territory, whereas most others witnessed promoting stress. Nifty Auto declined by 0.3 per cent, Nifty FMCG traded flat within the pink, and Nifty Pharma was down by 0.29 per cent, indicating selective participation from traders.

Sunil Gurjar, SEBI-registered analyst, Founder, Alphamojo Financial Services, acknowledged, ‘The Nifty 50 didn’t carry out nicely final week, remaining flat. Due to this ‘tug-of-war,’ the index remained largely unchanged. This consolidation is because of numerous conflicting components, together with optimistic news (like potential repo price cuts, Nifty reaching an ATH, the Russia-India commerce deal, and the IPO booming) and unfavorable issues (like rupee weak point, heavy FII promoting, and geopolitical stress). Overall, the Nifty 50 is exhibiting sturdy relative power, inching in the direction of a brand new excessive. Technically, the value buying and selling above all key shifting averages additional indicators extra potential upward momentum within the sector.’

Meanwhile, the IPO market stays energetic with sturdy investor curiosity. The Meesho IPO allotment might be finalized right now.

The problem was oversubscribed 23.33 instances, with the retail phase subscribed 15 instances, QIB by 17 instances, and NII by 28 instances, signaling vital demand for the providing.

The e-commerce platform’s IPO has a worth band mounted between Rs 105 to Rs 111 per share, with a complete problem dimension of Rs 5421 crore.

On the worldwide entrance, issues persist as China-Japan relations deteriorate, posing challenges to market sentiment in Asia. The US publishing a brand new National Security Strategy has sparked fear amongst European allies and South American states, including additional layers to the geopolitical uncertainty influencing markets.

Experts additionally consider that upcoming selections by main world central banks will play a vital function in guiding market momentum. The conferences of the European Central Bank (ECB), the Bank of England, and the Bank of Japan scheduled for subsequent week are anticipated to attract shut consideration.

The Bank of Japan is anticipated to boost charges by 0.25 per cent, a transfer that would influence carry commerce momentum, though markets have had time to cost within the risk.

In different Asian markets, main indices witnessed blended sentiment throughout Monday’s opening session. Japan’s Nikkei 225 index was down by 0.13 per cent, Hong Kong’s Hang Seng index fell by 0.77 per cent, Singapore’s Straits Times declined by 0.34 per cent, whereas South Korea’s KOSPI index traded up by 0.22 per cent. (ANI)