Pune [India], September 25 (ANI): Union Finance Minister Nirmala Sitharaman has stated that India’s resilience stands out amidst an unsure international setting and several other beneficial components, together with a younger demography and home demand, present core power to the Indian economic system to face up to international spillovers and develop at the next aspirational trajectory.

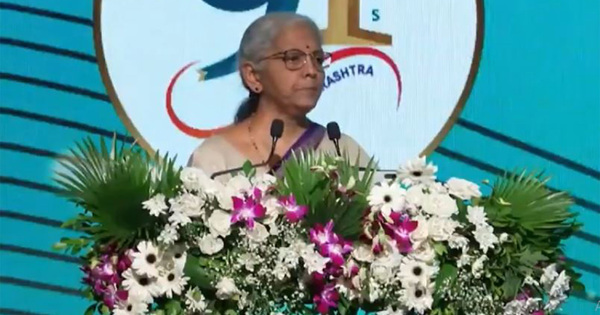

Addressing the 91st Foundation Day celebrations of Bank of Maharashtra, she stated India’s resilience shouldn’t be unintentional and displays proactive fiscal and financial insurance policies, structural reforms, improved governance and enhanced competitiveness during the last decade.

‘Amidst this unsure international setting, India’s resilience stands out. Several beneficial components, equivalent to robust macroeconomic fundamentals, a younger demography and higher reliance on home demand, present core power to the Indian economic system to face up to international spillovers and develop at the next aspirational trajectory. Post-COVID, India rebounded strongly, recording a median annual development of about 8% throughout 2021-22 to 2024-25. It stood out because the fastest-growing main economic system on the earth,’ Sitharaman stated.

‘This financial resilience has continued, with India’s GDP rising by 7.8% within the April-June quarter. India’s resilience shouldn’t be unintentional. They mirror proactive fiscal and financial insurance policies, daring structural reforms, huge infrastructure creation, each bodily and digital, improved governance and enhanced competitiveness during the last decade,’ she added.

Sitharaman famous that S&P upgraded India’s sovereign credit standing to ‘BBB’ (from BBB-) in August 2025 after 18 years, and Morningstar DBRS upgraded us to ‘BBB’ from BBB (low) in May 2025. Recently, Japanese credit standing company, Rating and Investment Information, Inc. (R&I), upgraded India’s long-term sovereign credit standing to ‘BBB+’ from ‘BBB’.

The minister famous that Bank of Maharashtra’s Return on belongings (RoA) of 1.8% in FY 2024-25 is method forward of the common RoA of Public Sector Banks, which stood at 1.1%.

‘The financial institution’s Cost to Income Ratio (CIR) for FY 2024-25 stands at 38.4%, which isn’t solely the bottom amongst Public Sector Banks (PSBs), the place the common CIR is 50.1%, but additionally surpasses the vast majority of personal sector banks. Additionally, a CIR beneath 40% is globally thought to be a superb benchmark. Similarly, financial institution’s CASA ratio of 53.3% is the best amongst Public Sector Banks (PSBs), the place the common CASA ratio is 38.8%, and it additionally surpasses the vast majority of personal sector banks,’ she stated.

The minister stated that as of June 30, 2025, Bank of Maharashtra’s Gross NPA stood at 1.74% and Net NPAs stood at 0.18%, at a multi-year low.

‘Provision Coverage Ratio improved to 98.36%. – Total Business grew by over 14% on Y-o-Y foundation to Rs 5.46 lakh crore. – Total Deposits elevated by over 14% on Y-o-Y foundation to over Rs 3 lakh crore. RAM (Retail, Agri and MSME) Business improved to 62.10% of Gross Advances. – Retail advances grew by 35% to Rs 71,966 crore on Y-o-Y foundation. MSME advances grew by 5.65% on Y-o-Y foundation,’ she stated.

She famous that the financial institution has helped open 1.21 crore Jan Dhan accounts, increasing entry to formal banking. Under social safety schemes, over 55 lakh folks enrolled within the PM Jeevan Jyoti Bima Yojana, 1.16 crore within the PM Suraksha Bima Yojana, and 17.7 lakh subscribed to the Atal Pension Yojana.

The financial institution has additionally been energetic in supporting entrepreneurship and livelihoods. Nearly Rs 33,000 crore has been disbursed beneath PM MUDRA loans to round 46 lakh accounts, whereas Stand Up India has supplied almost Rs 1,200 crore to over 5,300 beneficiaries as of March 31. Additionally, greater than 1.67 lakh road distributors acquired credit score help beneath the PM SVANidhi scheme. These initiatives underscore Bank of Maharashtra’s important function in selling monetary inclusion and supporting India’s grassroots economic system.

Sitharaman stated that with uncertainty remaining a defining characteristic of the worldwide panorama, the function of banks turns into much more essential, not simply as custodians of financial savings, however as engines of development, offering the finance and help that companies and entrepreneurs have to navigate volatility, seize alternatives and drive innovation.

‘One precept which we will always remember to stick is adhering to the core precept of buyer belief which is the muse of banking. Every grievance should be seen as a chance to enhance, innovate and reinforce belief. Grievance redressal should go hand-in-hand with root trigger evaluation, systemic corrections in merchandise, processes and conduct, and a dedication to make sure the identical grievance doesn’t come up once more,’ she stated.

The minister stated that the success of UPI exhibits what interoperability can obtain.

‘A current IMF be aware highlights the potential of UPI’s interoperable design as a mannequin for the world. It is, nonetheless, necessary to do not forget that digitalisation alone shouldn’t be sufficient. Integrity, empathy and human judgment stay irreplaceable,’ she stated.

The minister stated that within the macroeconomic and likewise total financial efficiency, the efficiency of Indian banks stands out significantly nicely. (ANI)