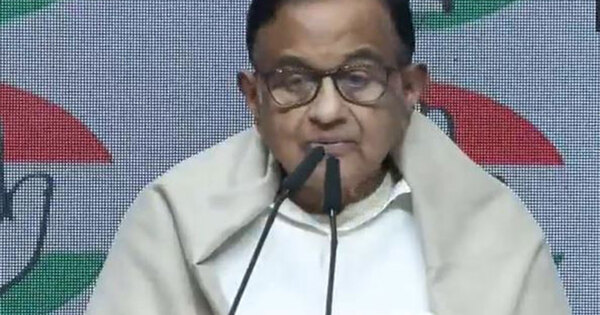

New Delhi [India], February 1 (ANI): Senior Congress chief P Chidambaram on Sunday stated the Union Budget offered by Finance Minister Nirmala Sitharaman in Parliament earlier within the day ‘failed the check of financial technique and financial statesmanship.’

Addressing a press convention right here, Chidambaram, a former Finance Minister, stated he isn’t positive if the Finance Minister and the federal government learn the Economic Survey 2025-26 and even when they’ve, they’ve determined to discard the challenged and fall again on ‘their favorite pastime of throwing phrases on the folks’.

‘Every pre-budget commentator and author, and each scholar of economics, should be astonished by what she or he heard within the Finance Minister’s speech to Parliament at this time, Chidambaram stated.

‘I settle for {that a} Budget is greater than a press release of annual revenues and expenditure. In present circumstances, the Budget speech should lay out a story that addresses the most important challenges outlined within the Economic Survey launched a couple of days in the past. I’m not positive if the federal government and the Finance Minister had learn the Economic Survey 2025-26. If that they had, it seems they’ve determined to discard it utterly, and fall again on their favorite pastime of throwing words–usually acronyms–at the folks,’ he added.

Chidambaram stated he can rely a minimum of 10 challenges recognized by the Economic Survey and plenty of educated consultants.

‘The penal tariffs imposed by the United States have created stress for producers, particularly exporters; protracted commerce conflicts that may weigh on funding; the rising commerce deficit, particularly with China; the low Gross Fixed Capital Formation (approx. 30 per cent) and the reluctance of the non-public sector to speculate; the unsure outlook for the circulation of FDI (overseas direct funding) into India and the persistent outflow of FPI for the final a number of months,’ he stated.

‘The agonisingly gradual tempo of fiscal consolidation and the continued excessive fiscal deficit and income deficit, opposite to the FRBM. The persistent hole between formally introduced inflation numbers and the bottom realities when it comes to payments for family expenditure, training, healthcare and transport; the closure of lakhs of MSMEs and the battle for survival of the remaining MSMEs; the precarious employment scenario, particularly youth unemployment and rising urbanisation and the deteriorating infrastructure in city areas (municipalities and companies,’ he added.

Chidambaram stated none of this was addressed by the Finance Minister’s speech.

‘Even by an accountant’s requirements, it was a poor account of the administration of the funds in 2025-26. Revenue receipts had been quick by Rs 78,086 crore, whole expenditure was quick by Rs 1,00,503 crore. Revenue expenditure was quick by Rs 75,168 crore and capital expenditure was minimize by Rs 1,44,376 crore (Centre Rs 25,335 crore and States Rs 1,19,041 crore). Not a phrase was stated to clarify this depressing efficiency. Actually, the Centre’s capital expenditure has fallen from 3.2 per cent of GDP in 2024-25 to three.1 per cent in 2025-26,’ he stated.

Citing examples, he stated in income expenditure, the cuts have fallen in heads that concern the frequent folks.

He stated funds have additionally been minimize in essential sectors and programmes. Expenditure on the much-vaunted Jal Jeevan Mission was cruelly minimize from Rs 67,000 crore to a paltry Rs 17,000 crore,’ he stated.

The Congress chief stated that after the months-long train, the revised estimate of the fiscal deficit has adhered to the finances estimate of 4.4 per cent, and the projection for 2026-27 is that the fiscal deficit will fall by a meagre 0.1 per cent of GDP.

He stated the income deficit will stay at 1.5 per cent and famous that ‘it’s actually not a daring train in fiscal prudence and consolidation’.

The Congress chief stated the Finance Minister just isn’t uninterested in including to the variety of schemes, programmes, missions, institutes, initiatives, funds, committees, hubs, and so forth. ‘I counted a minimum of 24. I depart it to your creativeness what number of of those will likely be forgotten and vanish by subsequent 12 months,’ Chidambaram stated.

He stated months after the passing of the Income Tax Act, 2026, which can come into drive on 1 April, 2026, the Finance Minister has tinkered with some charges.

‘While the affect of the quite a few minor modifications needs to be examined rigorously, it should be remembered that the overwhelming majority of the folks don’t have any concern with revenue tax or revenue tax charges. As far as oblique taxes are involved, the typical individual will likely be involved with solely paragraphs 159, 160 and 161 of the speech. I welcome these minor concessions. Our verdict is that the Budget speech and the Budget fail the check of financial technique and financial statesmanship,’ he added. (ANI)