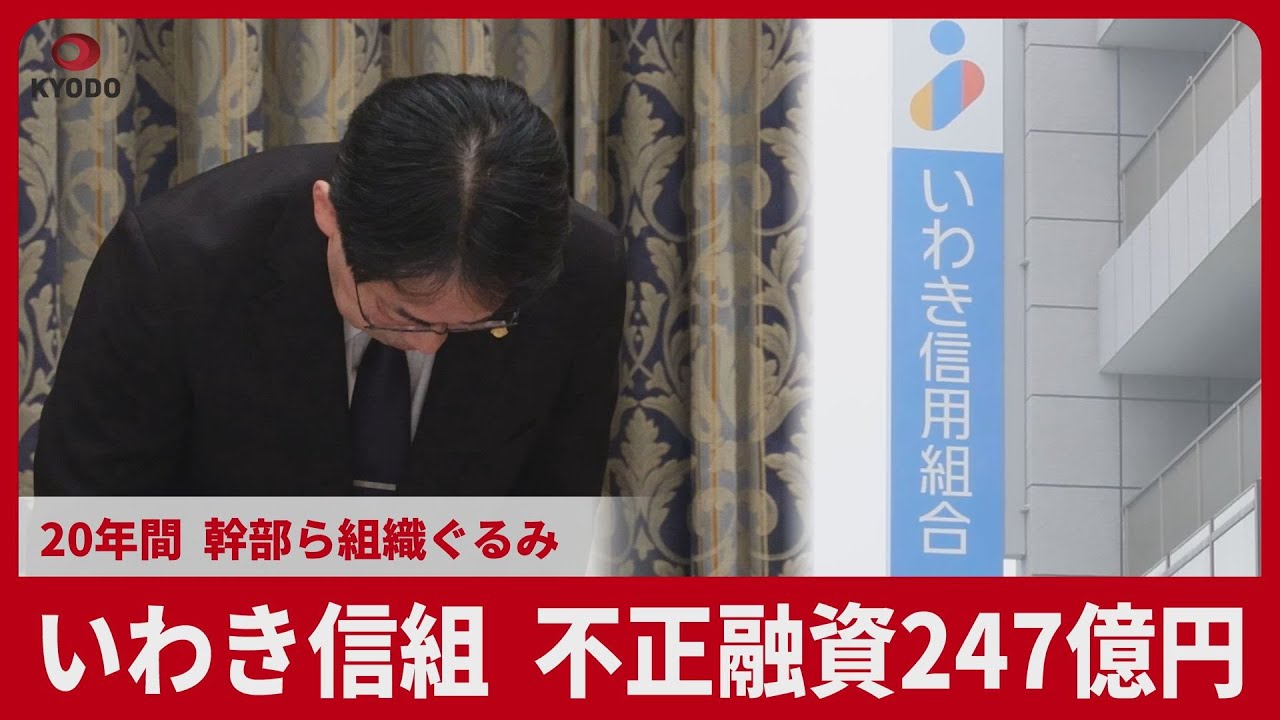

FUKUSHIMA (TR) – A 3rd-party committee tasked with unraveling the covered-up fraudulent practices of a credit score union in Iwaki City revealed final week that the establishment created faux loans with a complete worth of practically 25 billion yen over a two-decade interval.

On May 30, the third-party committee, composed of legal professionals and others, stated in a report that credit score union Iwaki Shinkumi Bank made fraudulent loans within the names of 263 individuals with out their data together with 1,316 accounts. Of these accounts, three had been for so-called “paper companies,” which means corporations with no precise enterprise.

The misappropriation, which started on the newest in March 2004, was meant to help the money movement of huge debtors in monetary issue.

The committee concluded that the scandal was coated up for therefore lengthy by means of the utilization of varied manipulation strategies to keep away from the eyes of exterior auditors, studies the Yomiuri Shimbun (May 31).

Not topic to annual audits

The complete quantity of fraudulent loans was 24.7 billion yen by means of final November, when the scandal surfaced.

Of the 1,293 fraudulent loans found within the investigation, 1,288 had been saved under 50 million yen. Crucially, loans beneath that quantity are usually not topic to exterior audits.

For these instances, the credit score union didn’t request monetary paperwork from debtors except there have been particular circumstances. Instead, they assessed the credit score danger primarily based on whether or not repayments had been in arrears.

As a consequence, the corporate was not topic to annual audits by accounting corporations. The report from the committee said that “the company controlled the amount of fraudulent loans and avoided an increased possibility of becoming the target of an audit.”

Another cover-up method was for a lot of executives and staff to fill out mortgage software varieties for fictitious loans in order that no two had been written in the identical handwriting.

A seal was additionally created in every depositor’s title. However, seal impression certificates or different gadgets sometimes wanted for a mortgage weren’t included within the mortgage purposes.

“Unavoidable”

Established in 1948, Iwaki Shinkumi Bank had 15 branches and round 41,800 members as of March. The credit score union had complete deposits of 204.1 billion yen 121.5 billion yen in loans. A big portion of its buyer base consists of small and medium-sized enterprises.

Former chairman Jiro Ejiri performed a number one position within the cover-up. He insisted in interviews with the third-party committee that “[The fraud] was unavoidable in order to protect the union. We could allow the union to collapse for the sake of small and medium-sized enterprises.”

The report identified that “pressure and justification that fraud was unavoidable in order to defend the organization were the cause of the incidents and long-term cover-ups.”

“It is truly inexcusable”

On May 29, the Tohoku bureau of the Ministry of Finance issued a enterprise enchancment order to Iwaki Shinkumi Bank. The ministry is requesting a clarification of administration duty, an additional investigation into the reality and an enchancment to a company tradition that lacks compliance consciousness.

That similar day, the financial institution stated that its then chairman, Yohachi Honda, and different executives will resign to take duty. “It is truly inexcusable,” Honda stated.

According to the ministry, Iwaki Shinkumi Bank repeatedly made fraudulent loans to its giant purchasers by means of the accounts funded by the aforementioned fictitious loans opened with out the permission of their account holders. They additionally utilized so-called “indirect lending” to the massive purchasers by means of paper corporations.

Indirect lending is an unlawful lending method through which a lender passes funds by means of a person or one other firm when they’re unable to lend on to a enterprise. This method is usually utilized by corporations which might be battling money movement.

Katsunobu Kato, the Minister of Finance, stated on May 20, “This is extremely regrettable. We strongly urge the credit union to thoroughly investigate the cause and implement effective measures to prevent recurrence. We will respond strictly in accordance with the law.”

The bureau stated that company governance didn’t operate as a result of large affect held by former chairman Ejiri.

The chair of the third-party committee, lawyer Hiromichi Niitsuma, stated on May 30, “The whole picture is far from being revealed.”

The third-party committee additionally identified: “This case, which involved many executives and employees over a long period of approximately 20 years and involved numerous criminal fraudulent loans, is an unprecedentedly heinous case in the history of financial institutions in Japan.”