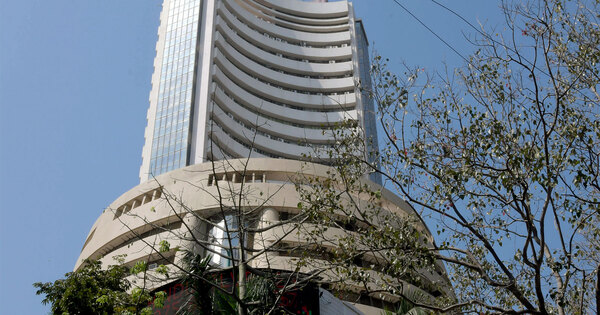

Mumbai (Maharashtra) [India], September 29 (ANI): The stock market opened flat in inexperienced on Monday after a pointy correction final week, as investor sentiment remained weak on account of U.S. President Donald Trump’s tariff insurance policies on pharma and their impression on India.

The benchmark Nifty 50 index opened at 24,728.55, gaining 73.85 factors or 0.30 per cent, whereas the BSE Sensex began the day at 80,588.77 with a rise of 162.31 factors or 0.20 per cent.

Market specialists famous that this week will see heavy exercise within the major markets, with a number of IPOs opening and a number of other listings scheduled, making it an IPO-heavy week. However, in addition they cautioned that strain on secondary markets could proceed, particularly for IT shares.

Ajay Bagga, Banking and Market Expert, advised ANI, ‘Asian markets are muted this morning. The RBI and the RBA price choices are in focus. It is a month-to-month expiry day for Indian derivatives on the NSE tomorrow, so rollovers will likely be watched, particularly the large brief positions of FPIs. The major markets appear to be in a unique actuality in India. 21 new points open this week, whereas 26 firms will see their itemizing debuts. Block offers of OFSs proceed apace, sucking out liquidity from secondary markets together with the IPOs. The IT sector is going through additional strain submit the Accenture outcomes and announcement of hundreds of job cuts by it.’

In the broader market indices, Nifty 100 opened with good points of 0.23 per cent, Nifty Smallcap 100 rose by 0.33 per cent, whereas Nifty Midcap 100 gained 0.42 per cent.

On the sectoral entrance, besides Nifty FMCG, all different sectors opened within the inexperienced. Nifty Auto was up 0.54 per cent, Nifty IT gained 0.33 per cent, Nifty Media rose 0.45 per cent, Nifty Metal added 0.47 per cent, Nifty Pharma climbed 0.45 per cent, whereas Nifty PSU Bank superior 0.53 per cent.

Globally, U.S. shares had a detrimental week with main indices falling between 0.2 to 0.8 per cent. The AI-driven rally witnessed some revenue reserving, and because of the concentrated nature of the U.S. markets, it had a broader impression.

Adding to this, a robust revision of U.S. Q2 GDP to three.8 per cent and a gentle PCE index studying indicated that tariffs have thus far neither slowed the U.S. economic system nor triggered runaway inflation.

However, issues persist over a potential U.S. authorities shutdown on the finish of the month on account of political disagreements, elevating dangers of miscalculation.

On the technical entrance, Sudeep Shah, Head – Technical and Derivatives Research at SBI Securities, highlighted that Nifty IT has seen a steep fall, tumbling practically 8 per cent final week.

‘It has given a horizontal trendline breakdown on a each day scale and slipped under its 200-week EMA stage. The weekly and each day RSI additionally slipped under the 40 mark, suggesting additional weak spot within the brief time period. Apart from this, Nifty Pharma, Healthcare, Consumer Durable, Financial Services, Capital Market, India Tourism, FMCG and Media are additionally prone to underperform within the brief time period,’ he mentioned.

In Asia, Japan’s Nikkei 225 index was down 0.95 per cent, whereas different main markets gained. Hong Kong’s Hang Seng index was up over 1 per cent, South Korea’s KOSPI gained 1.24 per cent, and Singapore’s Straits Times superior 0.18 per cent. (ANI)