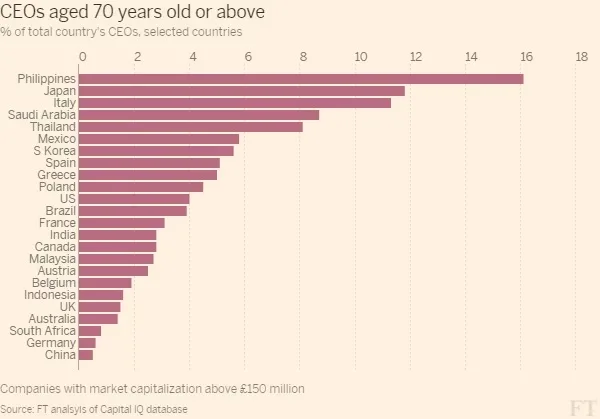

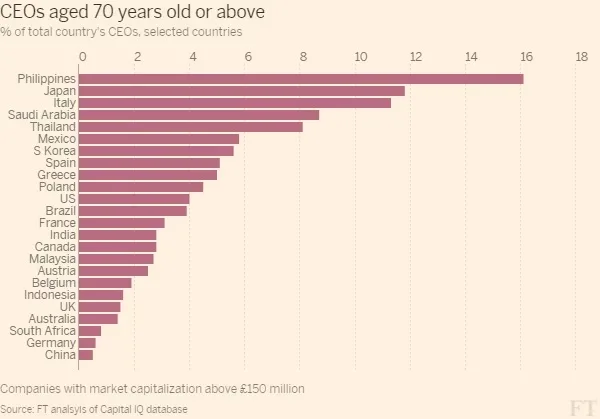

By 2025, 1.3 million Japanese enterprise homeowners shall be over 70 years previous with no successor. This might result in the closure of 620,000 worthwhile companies, shrinking Japan’s GDP by $165 billion and eliminating 6.5 million jobs. The youngest billionaire you’ve by no means heard of is tackling this disaster head-on with AI: Shunsaku Sagami.

A Personal Loss That Sparked a Vision

Shunsaku Sagami’s journey started in Osaka within the Nineteen Eighties when his grandfather’s thriving actual property company was pressured to close down because of the lack of a successor. Seeing the corporate’s license faraway from the wall was a defining second, planting the seed for his future enterprise imaginative and prescient.

From Biology to Billionaire: Sagami’s Unconventional Path

Sagami graduated from Kobe University with a level in biology and agriculture. An avid Mahjong participant, he credit the sport for honing his enterprise acumen. Today, at simply 33 years previous, he’s Japan’s youngest billionaire, with a internet price of $1.9 billion.

But his rise was removed from simple.

The Frustration That Led to Innovation

In 2017, Sagami offered Alpaca, a ladies’s style and cosmetics enterprise. The sale course of was irritating:

- It took over a 12 months to finish.

- Required months of guide analysis.

- Incurred retainer charges no matter success.

This inefficiency led him to a game-changing resolution.

The Birth of AI-Powered M&A

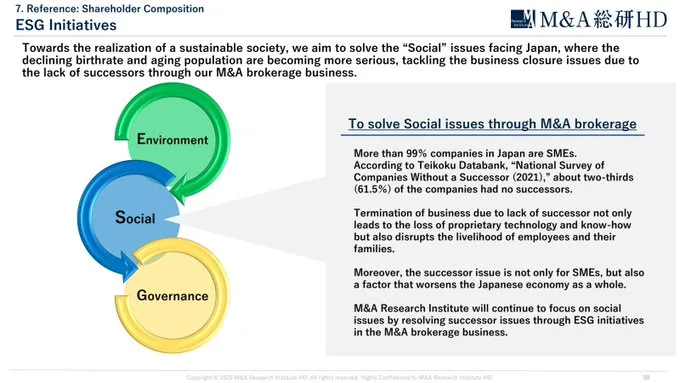

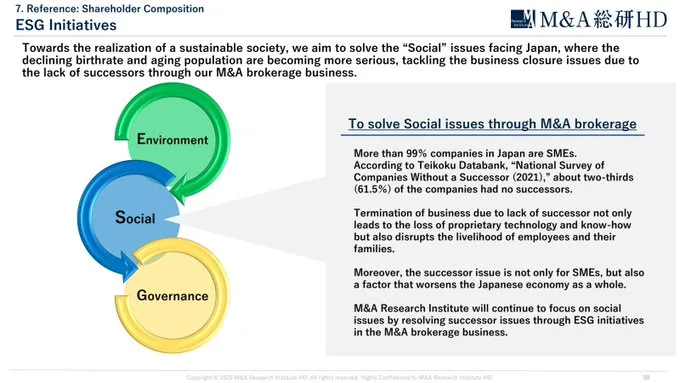

In 2018, Sagami launched the M&A Research Institute, a Tokyo-based M&A brokerage that leverages AI to assist ageing enterprise homeowners discover successors. His AI-driven method was impressed by Japan’s automation big Keyence Corp.

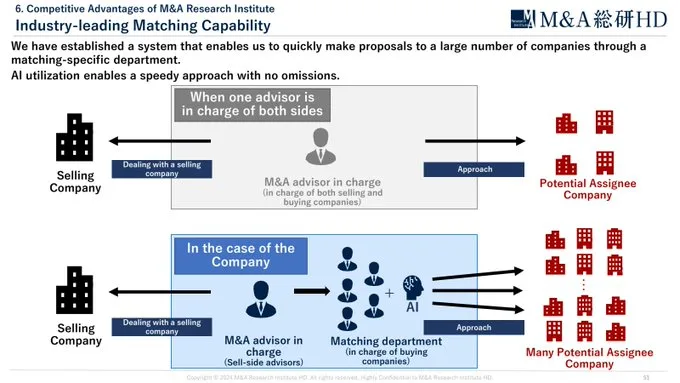

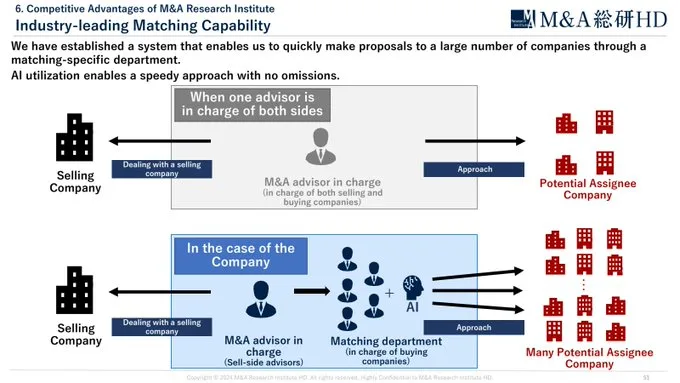

The actual breakthrough got here when he modernized Japan’s M&A business with proprietary AI options:

- Business matching algorithms

- Automated doc evaluation for sooner due diligence

- Machine studying to match appropriate consumers and sellers

How AI is Revolutionizing Japan’s M&A Industry

The affect of Sagami’s AI system was quick:

- Reduced deal instances from 6 months to 49 days

- Eliminated retainer charges, charging solely success-based charges of as much as 5%

- Streamlined paperwork by means of in-house digital software program

This transformation disrupted conventional M&A practices, making acquisitions sooner, cheaper, and extra accessible.

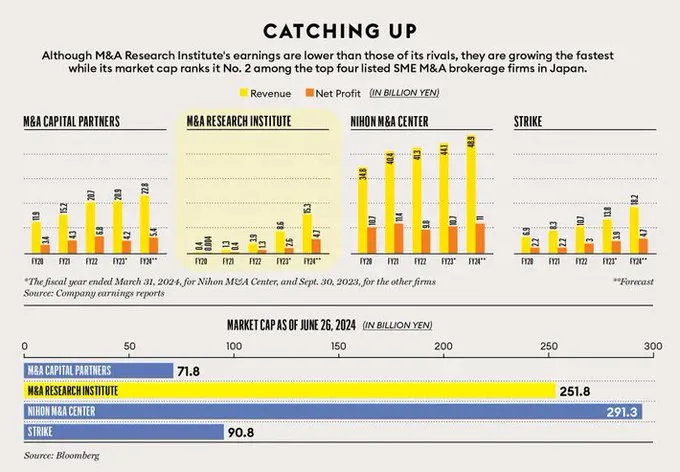

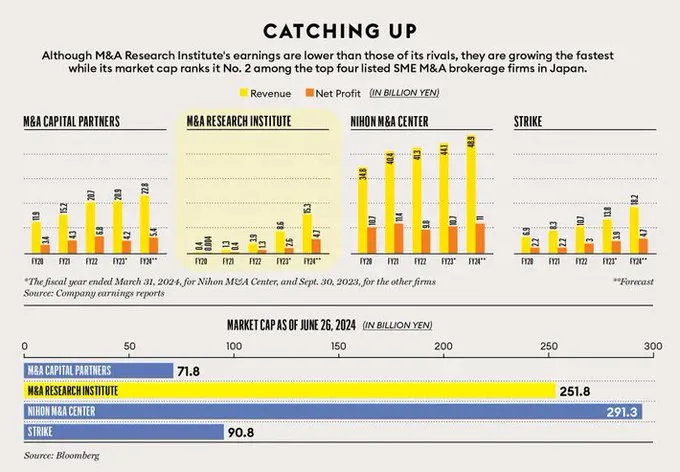

Rapid Growth and Market Dominance

In simply the first six months, M&A Research Institute:

- Completed 62 offers price ¥3.9 billion ($26.5 million)

- Expanded to over 300 workers

- Handled 500 simultaneous offers

- Listed on the Tokyo Stock Exchange in 2022

Today, it’s Japan’s go-to M&An answer for small to medium-sized enterprises.

A Billionaire with a Mission

Sagami owns 72% of the corporate, but regardless of his immense wealth, he stays humble:

“I’m not quite sure how I feel about my wealth, but I continue to work hard to create good businesses.”

His subsequent purpose? Global enlargement.

A Lesson in Problem-Solving

Sagami turned a private downside right into a nationwide resolution. His innovation is now tackling Japan’s largest financial disaster.

As Elon Musk as soon as mentioned:

“You get paid in direct proportion to the difficulty of problems you solve.”

The takeaway? Big options typically begin with small issues.