TOKYO, Dec 03 (News On Japan) –

A surge in costs is hitting native festivals throughout Japan, with the centuries-old Chichibu Night Festival, one of many nation’s three main float festivals, lowering its conventional fireworks program by 200 pictures after pyrotechnic prices soared, because the Highashi administration rolls out inflation countermeasures that goal to help households however have prompted considerations that they could find yourself accelerating inflation as an alternative, elevating questions on how these insurance policies will in the end have an effect on on a regular basis life.

The Chichibu Festival, which started at present and boasts a historical past of greater than 350 years, is already feeling the pressure of rising uncooked materials costs. Organizers say the price of gunpowder used for every giant shell has climbed by greater than 20,000 yen over the previous two years, making it tough to take care of earlier years’ volumes.

Price pressures are additionally evident at meals stalls lining the competition grounds. One vendor promoting obanyaki raised costs by 50 yen final yr, explaining that the price of flour and sugar has climbed throughout the board. The vendor mentioned they’ve held costs regular once more this yr to draw extra clients, regardless that profitability is shrinking. Another stall promoting fried noodles raised its worth from 500 yen final yr to 600 yen this yr, saying that the intention was all the time to maintain it at 500 yen however that rising prices made it unimaginable.

In Chichibu, the town has begun distributing rice to residents from August as an area measure to ease the impression of inflation. At the nationwide degree, the federal government is rolling out help equivalent to subsidies for rice and electrical energy and gasoline payments, although expectations amongst households seem muted. Residents expressed considerations that the deliberate phaseout of the short-term gasoline tax discount will hit car-dependent areas exhausting, saying that even with help, rising bills outpace earnings and any help is rapidly consumed, leaving day by day life largely unchanged.

Inflation can also be impacting year-end and New Year eating tables. One resident mentioned rising costs for truffles have develop into noticeable forward of Christmas subsequent month, including that they plan to forgo a vacation cake this yr. A store in Fukuoka raised the worth of its 15-centimeter entire cake by 100 yen to 4,900 yen, reflecting greater ingredient prices. According to Teikoku Databank, the typical worth of Christmas truffles continues to rise on account of surging uncooked materials bills.

Amid these traits, a easy cake from Lawson, stripped of ornamental toppings to maintain costs down, is gaining reputation. The worth is roughly half that of strawberry-topped truffles, and reservations are up 1.7 occasions in contrast with final yr.

Osechi dishes are additionally turning into dearer. A prepared-food producer based mostly in Aichi Prefecture raised the worth of its three-tier osechi set by 1,000 yen as the price of substances for 33 objects, in addition to ornamental containers, pouches, and lacquered tiers, has elevated.

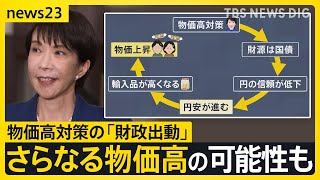

The authorities’s supplementary funds, which incorporates inflation countermeasures, totals 18.3 trillion yen, greater than half of which—11.6 trillion yen—will probably be financed by means of authorities bonds. The Fiscal System Council submitted its opinion paper to Finance Minister Katayama at present, urging the federal government to safe steady funding sources whereas making certain market confidence in Japan’s fiscal coverage, warning in opposition to overly expansionary spending.

If markets lose belief in Japan’s fiscal administration, the yen may weaken additional. A weaker yen would make imported meals and power dearer, accelerating inflation. Ironically, fiscal measures designed to offset rising costs may find yourself fueling even greater inflation.

At the Diet at present, the LDP’s tax panel convened for discussions beneath the brand new political management. The focus has turned to tax cuts, with the income-cap threshold already raised to 1.6 million yen and additional will increase to 1.78 million yen—proposed by the Democratic Party for the People—estimated to value round 2 trillion yen in decreased tax income. Eliminating provisional gasoline and diesel tax charges would lead to one other 1.5 trillion yen in tax cuts.

Finance Ministry officers warn that whereas the fiscal losses are substantial, the federal government and ruling events could understand political beneficial properties. Although the ruling coalition holds a majority within the Lower House, it lacks a majority within the Upper House, making opposition help important. Lawmakers warning that except tax cuts are accepted, parliamentary enterprise may stall, incentivizing insurance policies which might be common with voters however defer heavier monetary burdens equivalent to tax will increase, doubtlessly resulting in inflation pushed by worsening fiscal well being.

Of the 18.3 trillion yen within the supplementary funds, roughly 9 trillion yen is allotted to inflation countermeasures. Around 64% of the general bundle will probably be financed by means of new bond issuance, elevating considerations that the strategy may contribute to additional inflation and a weaker yen. Commentators argue that relying closely on bond-funded supplementary budgets is unprecedented and more and more dangerous, particularly as long-term authorities bond yields proceed to rise.

According to analysts, Finance Ministry officers say they’re nervous every Monday as markets open, noting that the pattern seems to be transferring in the wrong way of sustaining market confidence. Without securing steady funding sources, even well-intentioned insurance policies danger turning into ineffective as a result of the federal government’s monetary basis is rising unstable.

Observers query why lawmakers aren’t elevating stronger considerations about fiscal sustainability, saying that explanations from policymakers lack readability about long-term outlooks. Critics argue that resorting to bond issuance every time funding falls quick is now not tenable, significantly by means of supplementary budgets, calling it a troubling observe that extends past what accountable monetary administration ought to enable. They stress the necessity for various, extra sustainable approaches to securing income.

Source: TBS