TOKYO (TR) – Executives from Prudential Life Insurance Co., Ltd. on Friday apologized at a press convention following revelations that workers inappropriately obtained over 3.1 billion yen from clients.

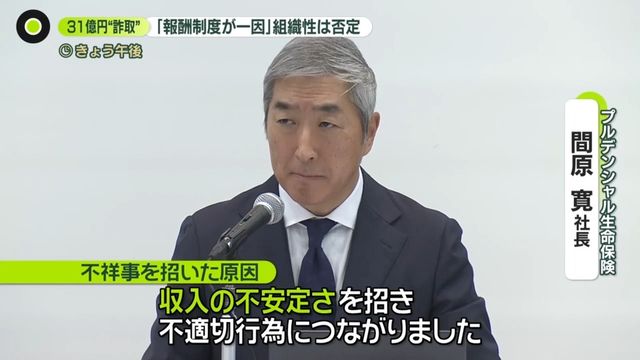

The press convention was the primary for the reason that scandal got here to gentle. President Hiroshi Mahara stated, “We offer our deepest apologies for the great anxiety and inconvenience caused. We are extremely sorry.”

Prudential Life Insurance is a foreign-owned firm that not solely sells life insurance coverage but additionally provides life planning companies, together with asset administration.

“We have discovered that 107 employees and former employees improperly solicited investments and improperly received a total of approximately 3.1 billion yen from 503 customers,” stated Mahara.

In response to this incident, Mahara has resigned, efficient on February 1.

As Nippon News Network (Jan. 23) experiences, the scandal, whose origin dates again many years, was clearly a matter of company tradition gone flawed.

Dating again 35 years

An inner investigation revealed a sequence of problematic practices, relationship again 35 years, wherein present and former workers defrauded clients.

The strategies used assorted. In one case, an worker, aged of their 30s, working at a department workplace in Minato Ward ready paperwork for patrons that listed the corporate identify “Prudential Life Insurance.”

However, the worker advised investments in fictitious monetary merchandise. As a end result, a complete of roughly 53 million yen was defrauded from 4 clients.

In one other case, an worker stated approached clients with funding concepts unrelated to the corporate’s insurance coverage enterprise and accepted their cash. “I want you to lend me money for investment,” the worker instructed clients.

In some instances, they requested clients to lend them cash after which by no means paid it again.

“Our sales systems made it easy”

Of defrauded quantity of greater than 3.1 billion yen, roughly 2.3 billion yen has by no means been repaid.

In explaining how workers have been capable of defraud the funds, Mahara stated, “First, our sales systems made it easy to commit inappropriate acts and difficult to detect fraud. Systems that were overly tied to performance attracted personnel who prioritized financial gain and led them to adopt such mindsets after joining the company. In addition, fluctuations in income based on sales personnel’s own performance led to income instability and led to inappropriate behavior.”

While acknowledging that “our internal compensation system was one factor in causing the problem,” he said that “there was no sharing of methods” amongst workers.

“There was a competitive spirit”

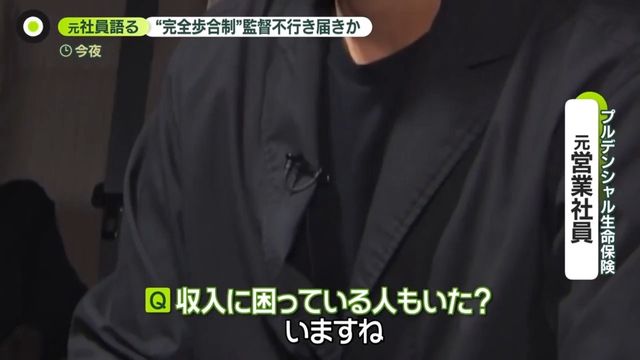

The community spoke with a former worker who labored in gross sales at Prudential Life for 2 years, beginning in 2018, to seek out out extra in regards to the state of affairs.

“There was a competitive spirit,” the foerm worker stated. “Awards got on a weekly, month-to-month and annual foundation. They submit issues like, ‘Today, such and such person was number one’ or ‘Number one for the week.’”

When asked if any employees were struggling, the former employee says there were.

“They were paid on a commission-based system, so if they don’t promote, they will’t pay their lease,” the previous worker stated. “I think that’s what happens to most people who quit. They can’t make a living.”

“In a bit of a bind”

After this problem surfaced, present workers have been contacted. They instructed tales like, “My policies are canceled” and “I can’t even meet with customers.”

Another former worker instructed the community, “The harder you work, the more your salary skyrockets, and vice versa. If you don’t sell, some people even make minimum wage. There were always people who eventually couldn’t sell insurance and were in a bit of a bind, so they borrowed money, and that information was shared within the company.”

The latter borrowing from clients was shared throughout conferences.

A former gross sales worker stated, “There were things that were really left to individual discretion, so I wonder if there are times when supervision is lacking.”

“Compensation Committee”

Of the 107 individuals concerned within the scandal, most have already left the corporate. The remaining 10 or so workers shall be fired.

In addition, Prudential Life Insurance will set up a “Compensation Committee” composed of third-party consultants to re-examine instances beforehand deemed ineligible for compensation. It will present compensation for these deemed mandatory.

Regarding the two.3 billion yen in unreturned funds, Akitomo Nakajima, an lawyer specializing in company scandals, says Prudential Life is liable.

“If they used the company’s name to explain or provide materials as if they were part of a Prudential product, and it’s normal to believe they were doing so as part of their job, then Prudential Life Insurance would be held responsible,” Nakajima stated.

However, it may very well be difficult.

“If they made solicitations unrelated to Prudential Life Insurance, such as ‘Here’s a lucrative business opportunity for you’ or ‘Extend a loan to me and I’ll pay you back double,’ I think it would be difficult to hold the company responsible,” Nakajima stated. “If the sales pitch was deceptive, it could be considered fraud, so it’s entirely possible that victims will file a police report and the police will begin an investigation.”