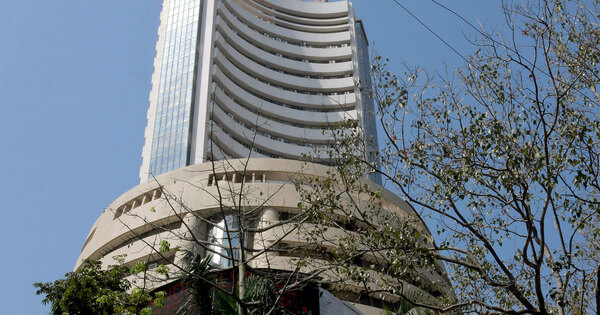

Mumbai (Maharashtra) [India], October 3 (ANI): The promoting stress returned to Indian markets on Thursday after a quick bounce again within the earlier buying and selling session, as persistent overseas investor outflows weighed on sentiments.

Both benchmark indices opened decrease, reflecting weak point throughout sectors, although choose pockets like metals and PSU banks managed to shine.

The Nifty 50 index opened at 24,759.55, slipping 76.75 factors or 0.31 per cent, whereas the BSE Sensex opened at 80,684.14 with a decline of 299.17 factors or 0.37 per cent.

The broader market confirmed blended developments, with the Nifty 100 down by 0.20 per cent, Nifty Midcap 100 edging up 0.14 per cent, and Nifty Small Cap 100 buying and selling flat in inexperienced with a marginal achieve of 0.02 per cent.

Among the sectoral indices on the NSE, FMCG, IT, media, and realty sectors have been beneath stress within the early session, whereas auto shares opened flat. In distinction, metallic and PSU financial institution shares have been among the many prime gainers, offering some cushion to the indices.

Meanwhile, gold continued its rally, marking new highs for the seventh consecutive week.

Manav Modi, Analyst – Precious Metals Research, Motilal Oswal Financial Services, stated ‘Gold held regular and was set for a seventh straight weekly achieve, buoyed by expectations of additional U.S. rate of interest cuts this yr and worries over the influence of a U.S. authorities shutdown. Meanwhile, silver in yesterday’s session witnessed some revenue reserving after hitting an all-time excessive on the home entrance and a 14-year excessive on COMEX.’

On the worldwide entrance, considerations remained heightened because the U.S. authorities shutdown entered its second day on Thursday.

The growth is prone to delay key financial information releases, together with the non-farm payrolls report and the unemployment price, each of that are intently watched by buyers. With the shutdown in impact, analysts imagine the labour statistics are unlikely to be launched on time, including uncertainty to market projections.

Back house, markets had staged a pointy restoration on Wednesday, snapping eight consecutive classes of decline.

Shrikant Chouhan, Head of Equity Research at Kotak Securities, famous, ‘On each day charts, the market has shaped a protracted bullish candle and a reversal formation, which helps an extra uptrend from the present ranges. We are of the view that 24,800/80,800 and 24,700/80,500 are key help zones for day merchants. As lengthy because the market trades above these ranges, a pullback formation is prone to proceed. On the upper facet, it may transfer as much as 24,950-25,000/81,300-81,500, and additional upside can also proceed, probably lifting the market as much as 25,075/81,700. However, beneath 24,700/80,500, market sentiment may change.’

In different Asian markets, Japan’s Nikkei 225 surged 1.46 per cent, Taiwan’s weighted index superior 0.98 per cent, whereas Hong Kong’s Hang Seng index slipped 0.95 per cent, indicating blended regional cues. (ANI)