Year-over-year gross sales have been flat. Subscriber rolls have been down in comparison with the ultimate three months of 2024. Earnings per share estimates have been far more sturdy than the precise EPS. That latter win led buyers to precise pleasure with the This autumn 2025 outcomes from Sirius XM Holdings Inc., with CEO Jennifer Witz gushing over longtime discuss host Howard Stern on the corporate’s early Thursday earnings name for shareholders and different events.

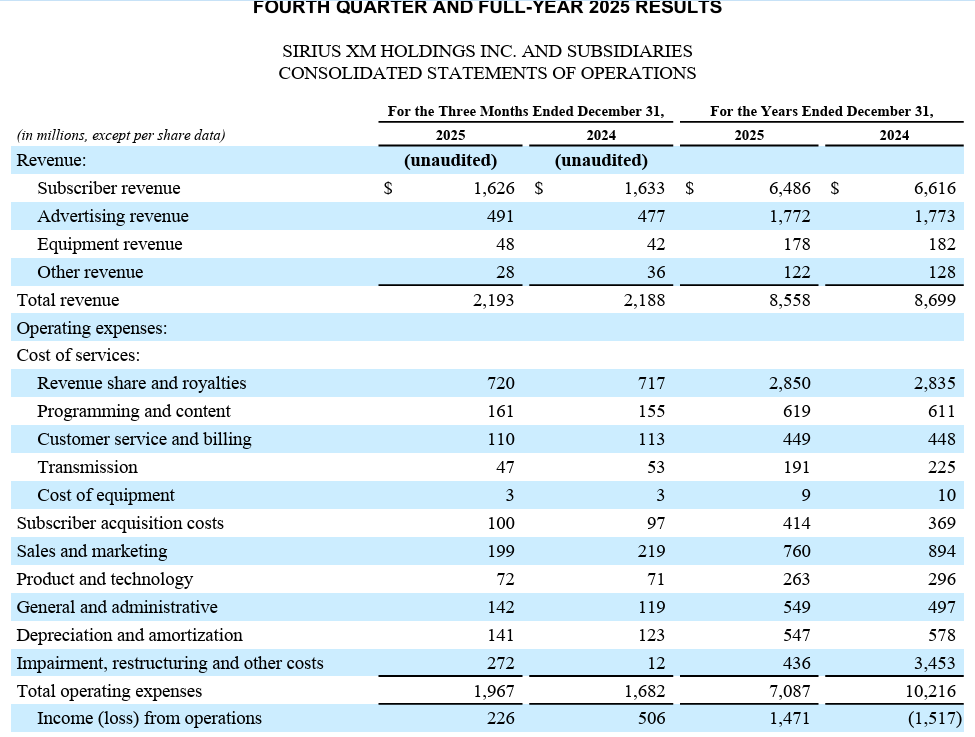

With Witz declaring that “Howard Stern is more relevant than ever,” because the longtime host signed a brand new three-year contract throughout autumn 2025, whole income in This autumn elevated to $2.193 billion, from $2.188 billion, as web revenue dipped to $99 million ($0.24 per diluted share) from $287 million ($0.83).

The EPS was a giant miss, coming in 53 cents decrease than consensus common of $0.77 per share. However, the whole income surpassed the $2.17 billion consensus estimate of some 13 analysts polled by Yahoo! Finance.

Adjusted EBITDA elevated to $691 million, from $688 million, in This autumn ’25.

Advertising income was $1.77 billion, roughly flat year-over-year, pushed primarily by power in podcasting and enhancing programmatic demand late within the yr. This offset an ongoing weak point in streaming music promoting.

As of three:45pm Eastern, Nasdaq-traded “SIRI” was up by 9.3% from Wednesday’s closing value, at $22.66 per share. While that’s welcomed news, Sirius XM stock is down by almost 11% in worth from 52 weeks in the past.

“We entered 2025 with renewed strategic focus as a fully independent public company, and we’re pleased to have overdelivered on our commitments, finishing the year with a strong fourth quarter, meaningful free cash flow growth, and exceeding our full-year guidance,” Witz mentioned.

Full-year steerage was supplied by Sirius XM, and it expects to have whole income of roughly $8.5 billion in 2026, with adjusted EBITDA of roughly $2.6 billion and Free Cash Flow of roughly $1.35 billion anticipated.

It’s the FCF that would have buyers significantly excited. By comparability, whole income of $8.56 million was seen in 2025, down from $8.7 million in 2024. Adjusted EBITDA for full-year 2024 was $2.67 billion, off from $2.73 billion in 2023. Free Cash Flow was $1.26 billion, up from $1.02 billion.

“In 2026, we are providing robust guidance that we believe reflects the overall stabilization of the business as we continue to lean into our strengths — our unique programming, leadership in the car, and audio advertising capabilities — to create deeper connections with listeners, deliver unparalleled audio experiences, and drive compelling results for our shareholders,” Witz added.

On the earnings name, Witz additionally signaled Sirius XM’s path paved on the finish of 2024, when it “refocused” its development technique by diminishing its advertising and promotion of the Sirius XM smartphone app as a result of sturdy competitors from all kinds of audio content material purveyors. With many customers contemplating Sirius XM as primarily an in-dash on-the-road audio providing, “we have remained laser-focused on bolstering our core SiriusXM in-car audience and expanding the reach of our ad network,” Witz instructed these on the decision.

That’s to not say on-demand audio is a fiscal flop. On the opposite, podcasting advert income grew 41% for the total yr, on prime of double-digit development in 2024, Witz shared.

Joining Witz in his first earnings evaluate for buyers was Chief Financial Officer Zach Coughlin. He succeeds Tom Barry.

Coughlin’s key takeaway? “Our core subscriber base remains stable, as reflected in full-year churn of 1.5%, one of the lowest levels in our history, and an improvement from 1.6% last year, supported by a durable subscriber base, with over half of our subscribers having been with SiriusXM for more than 10 years,” he mentioned on the decision. “We view our strong churn performance as a key result of improving our value proposition and overall customer satisfaction, and looking forward, we expect it to remain in the 1.5%-1.6% range. From an ARPU perspective, fourth quarter ARPU was up $0.06 to $15.17 as rate increases rolled through the base, partially offset by an increase in subscribers on promotional plans. For the full year, ARPU was $15.11, down $0.10 from last year.”

With liquidity “strong,” and entry to a $2 billion revolving credit score facility that continues to be largely undrawn in place, Coughlin says Sirius XM ended 2025 with a web debt to Adjusted EBITDA ratio of roughly 3.6x, “continuing our path towards our long-term target range of low- to mid-3x, which we expect to reach by late this year.”